Introduction

Starting June 19, 2025, the European Union will roll out the AIS/IMPORT PLUS system—a major step in the update of import procedures across member states. This upgrade replaces the existing AIS/IMPORT framework and introduces fully electronic customs declarations in line with the EU’s Union Customs Code (UCC).

The transition is part of the EU’s broader effort to harmonize and digitize cross-border trade operations, supporting faster customs processing, improved data accuracy, and stronger regulatory compliance.

Production Pilot Phase

Prior to the official launch, EU member states are expected to conduct production pilot tests of the AIS/IMPORT PLUS system. These pilots allow companies to trial declarations in real conditions. A key consideration: there will be no automatic data migration from the current systems, so all existing operations must be closed before migration.

What’s New in AIS/IMPORT PLUS?

1. Integration with Key EU Systems

The new system is fully integrated with other EU-level platforms such as:

- NCTS2 PLUS (transit)

- RPS (risk analysis)

- ISZTAR4 (tariff classification)

Communication and updates will be centralized via each country’s customs portal (e.g., PUESC in Poland).

2. Changes in Temporary Storage and Payment Procedures

Updates to temporary storage declarations (DSK) and payment mechanisms will streamline logistics while aligning with EU customs standards.

3. Discontinued Simplified Procedure for Certain Goods

Under AIS/IMPORT PLUS, simplified declarations will no longer be permitted for goods requiring:

- Sanitary inspection

- Phytosanitary checks

- Veterinary controls

- Commercial quality assessment (especially agri-food products)

Key Technical and Procedural Changes

1. Change of message names

The names of messages sent after customs clearance will change. For example, the current message ZC299 will be replaced by ZC429

2. Entity Identification via EORI Only

The identification of the entity data of the Importer/Buyer will change. In customs documents, the identification of entities will be based solely on the EORI number (NIP, REGON). Verification and possible update of data in PUESC/EORI is required, especially if there have been changes in the company address or legal form. Failure to update this information may result in outdated importer data appearing on the customs document

3. Structure of customs declaration numbers

The structure of customs declaration numbers will be updated under AIS/IMPORT PLUS.

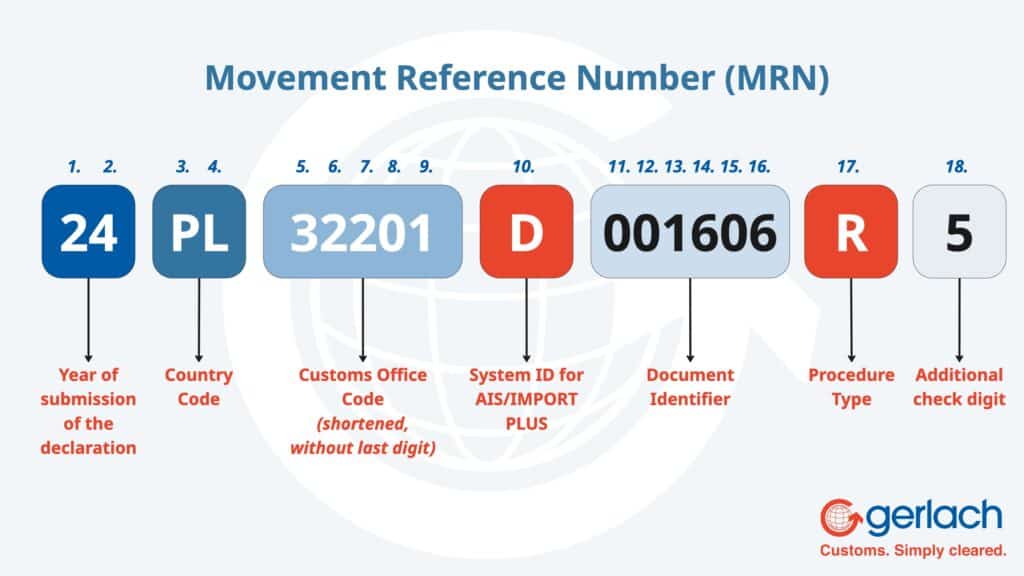

Example of an MRN Number

24PL32201D001606R5 – This MRN includes:

24: Year of submission of the declarationPL: Country code32201: Customs office shortened to 5 charactersD: System ID for AIS/IMPORT PLUS001606: Unique document identifier (letters allowed)- R: procedure identifier, by which the document type can be recognized in the AIS/IMPORT PLUS system

- 5: Check digit

Procedure code (17th character):

| Letter | Procedure Type |

|---|---|

| N | PWD-S |

| O | PWD-W |

| R | ZCP, ZCP-UPR, ZCP-UZP |

| U | DSK |

| V | ZCP (with F15 – special tax zones) |

| Z | PPW |

Possible Technical Issues

During initial rollout, users may experience temporary slowdowns or limited system availability as national customs authorities stabilize the new system. Businesses are encouraged to prepare contingency plans.

Ready to Navigate AIS/IMPORT PLUS?

The transition to AIS/IMPORT PLUS is a major shift—but your business doesn’t have to face it alone. Gerlach Customs is here to guide you through the changes, from updating EORI records to adapting declaration processes and systems integration.

With deep expertise in EU customs regulations, we help businesses adapt quickly and stay competitive in an evolving trade environment.

Contact us today for a consultation—our team is always available to assist you!